As a disclaimer let me say that I no longer own Fairfax except for a few shares just so I can get the annual report sent to me and attend the annual meeting if I want to. But I do that for almost all the companies I've owned over time. Anyways, here we go:

1. The insurance and underwriting results:

Nothing much to say here other than very good results. A

combined ratio in the low 90s is pretty outstanding actually, so maybe Fairfax

should be given the benefit of the doubt that their insurance operations have

finally turned a corner and are now really good performers.

However, let’s keep in mind that it

was a very light catastrophe year and they’re only 2 years removed from a

combined ratio of 114 and underwriting losses of $750M, albeit 2011 was a very

bad cat year, and a lot of the windfall in 2013 comes from releasing reserves set up

during those bad years. But then again, in the insurance world you’re always better off with a company that conservatively over reserves than the opposite.

Now the bad stuff…

2.The Hedges

Since I was a very young kid my dad always told me that a good way to deal with big picture issues in life was to worry about the details and the big picture would somehow take care of itself. And it's when I look at the details of Fairfax' hedges that I start feeling uneasy. Here they are:2.The Hedges

Timing:

The timing is the very first head scratching thing that can lead one to think that the Fairfax team, fresh from their 2007-2008 success (not due to macro calls IMO, more on this later), might be falling in love with the macro picture.

A few excerpts from their disclosures to illustrate this point.

Here's a disclosure from the 2008 AR that we would all expect from them:

“In November of 2008, after the stock markets had dropped 50% from their highs, we decided to remove the equity hedges on our portfolio investments.”Great, all is well. But then very soon thereafter, by Q3 2009, the hedges were back on – from Q3 ’09 conference call:

“ At September 30, in fair value terms we had $5.9 billion worth of equities, about 25% of our overall portfolio. Just like to point out that a lot of these holding were acquired in the fourth quarter of '08 and the first quarter of '09 when the S&P 500 was bouncing around between 700 and 900 index value. At September 30, the S&P 500 was at 1,057. As Prem said, in the nine-month period, on a price appreciation basis alone, it was up 17% to date to yesterday’s close.

And that lead us to put in place the hedge that we talked about. So we’ve hedged about a quarter of those equity holdings that I told you about of $5.9 billion. We’ve put in $1.5 billion of S&P 500 referenced total return swaps at the S&P 500 level of 1,062”So by September 2009, even though much of the World was still very much fearful, they’re back to being bearish after a 17% rise in the market and I would bet that many can agree that bargains were still abundant at that time. By mid 2010, 90% of their portfolio was hedged and it’s been about 100% thereafter. You can quote Buffett all you want about being greedy when others are fearful but this is certainly not what they were doing in my opinion, they were also fearful.

Cash Burden:

Even though Prem likes to talk about the temporary mark to market adjustments that these derivatives require and how they would reverse in the “long term”, there are details about them that hurt the company in the meantime (assuming they even reverse).

By the way, many have correctly noted that talking about mark to market fluctuations is no longer correct at the very least for the $1.4B losses that were realized in 2013. And for those realized losses, I would hope that someone who prides himself in being frank with shareholders, a la Warren Buffett, would put more emphasis in his letter on the fact that for a company with $8B in book value and a $9B market cap that $1.4B is a significant amount of money that is gone and not some temporary adjustment, instead it is just mentioned in the letter in passing as a byproduct of them having to reduce their hedges after they sold some stocks because “they had become expensive” (more on this later also).

Now, when I speak of details, here are the details that I think most people overlook that are worrisome about the total return swaps, they’re a cash burden when they’re going against you:

Per Fairfax disclosures, these swaps reset on a monthly or quarterly basis depending on the contract, and Fairfax is required to pay cash when they’ve gone against them. I also believe it ends up driving some of the actions they’ve taken recently. Here’s a table summarizing the cash that they’ve had to pay out (or receive) since 2010 (this is before any collateral requirement that some contracts also carry with them):

Now, when I speak of details, here are the details that I think most people overlook that are worrisome about the total return swaps, they’re a cash burden when they’re going against you:

Per Fairfax disclosures, these swaps reset on a monthly or quarterly basis depending on the contract, and Fairfax is required to pay cash when they’ve gone against them. I also believe it ends up driving some of the actions they’ve taken recently. Here’s a table summarizing the cash that they’ve had to pay out (or receive) since 2010 (this is before any collateral requirement that some contracts also carry with them):

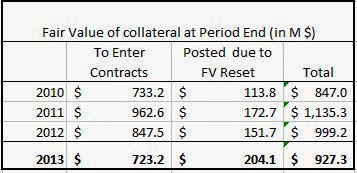

Additionally, some collateral in the form of cash or short term investments is required to be deposited to enter into those contracts as well as depending on the FMV of the derivatives at the reset date (Note: I do believe almost all the collateral still earns interest for Fairfax when deposited but it is still cash that is tied up). Here is a summary of the year end FV of the collateral deposited for the benefit of counterparties since 2010.

This adds up to a total of $4.2

billion in either cash paid out or tied up as collateral.

According to Prem all this is just mark to market fluctuations and it will reverse in

their favor, maybe, but let's not pretend that we live in a World with no

opportunity cost attached to what we do and this is cash that could have served other purposes like maybe being invested to take advantage of the recent one in a generation bear market to acquire a few businesses with

good cash flow generation to strengthen Fairfax or maybe (a favorite of Fairfax followers that I completely agree with) reduce your leverage if it’s keeping you

up at night, that way you won’t have to constantly place wild macro bets every

chance you get, supposedly to protect your equity portfolio.

Earlier I said that I thought all this ends up driving some of the actions we've seen Fairfax undertake recently. Here's what I mean by that:

Like many others I was surprised when I looked at the filings to see that they had sold about $1.4B in stocks. If the explanation for the "hedges" is that you have a portfolio of long term holdings you want to protect and you’re pretty sure that these hedges (maybe I should just call them bets) will pay-off, then why sell your holdings? You don’t even have to go far to find proof of this inherent contradiction, it’s right there in this year’s letter:

“We continue to like the long term prospects of our common stock holdings, while our hedges protect us against our near term economic concerns.”

But… you’re selling Prem… And then one gets even more confused as you continue

to read the letter. Prem uses up some serious ink to complain about the overvaluation

of Twitter, Facebook, Tesla, Amazon, Whatsapp etc. many of which I agree with,

but then they go ahead and sell Wells Fargo, US Bancorp, and JNJ??

As a reminder here’s how these companies were described by Prem in 2008, when he was seriously building up these positions – From the 2008 AR (The stocks mentioned as being in a "table below" were WFC, JNJ and KRFT):

As a reminder here’s how these companies were described by Prem in 2008, when he was seriously building up these positions – From the 2008 AR (The stocks mentioned as being in a "table below" were WFC, JNJ and KRFT):

“In previous annual reports, we have discussed the holding of some common stock positions for the very long term. Last year we identified Johnson & Johnson as one name and said that Mr. Market may give us more opportunities in the future. As shown in the table below, at the end of 2008 we had taken advantage of the major decline in stock prices to purchase additional positions in outstanding companies with excellent long term track records which we contemplate holding for the long term.”

So what the hell happened then? Twitter and FB are overvalued so you sell your "very long term holdings" in WFC, a company that I wouldn't particularly qualify

as overvalued by any stretch of the imagination.

I’m not sure I buy any of

that, so I won’t.

Here’s what makes more sense to me. Luckily for me the paragraph that discusses the stock sales is right next to the one that discusses the cash being forked over due to swap resets (emphasis mine):

“As a result of the significant appreciation of certain of its equity and equity-related holdings, the company reduced its direct equity exposure through net sales of common stocks and convertible bonds for net proceeds of $750.5 and $1,385.9 in the fourth quarter and full year of 2013 respectively (…)”

“During the fourth quarter and full year of 2013 the company paid net cash of $502.7 and $1,956.2 respectively (paid net cash of $39.4 and $837.6 during the fourth quarter and full year of 2012 respectively) in connection with the reset provisions of its short equity and equity index total return swaps (excluding the impact of collateral requirements). The company funded these payments through sales of common stocks and convertible bonds as described in the preceding paragraph.”I might be wrong, but it makes more sense to me that they are being forced to do this because of the need to come up with cash and collateral (just one man’s opinion, but that’s what makes sense to me). If that is the case then why not stay true to themselves and stand behind their bets and own up to the consequences they have on the business and more importantly be forthright with your partners and not say that Wells Fargo and JNJ are so overvalued that they have to start selling the companies. I’ve heard Prem say many times that you need to stay frank not only not to fool others, but more importantly so that you don’t fool yourself.

Let's also remember that Prem wants to keep at least a billion in cash at the holding company to be well capitalized.

And finally, one last detail to remember is that out of nowhere they issued $400 million worth of shares late last year and diluted shareholders by some 5%. I don’t think anybody had been anticipating the need for this cash raise from Fairfax and if you look closely a bit more than half of their stock sales also happened in Q4. And all this is before we get to the cash that had to be invested in Blackberry also in Q4, which I’ll get to later.

And finally, one last detail to remember is that out of nowhere they issued $400 million worth of shares late last year and diluted shareholders by some 5%. I don’t think anybody had been anticipating the need for this cash raise from Fairfax and if you look closely a bit more than half of their stock sales also happened in Q4. And all this is before we get to the cash that had to be invested in Blackberry also in Q4, which I’ll get to later.

3. The CPI Contracts

Many have compared these to the CDS investments they made before the financial crisis and I can see why, they’re similar in the sense that the premiums currently

being paid are a tiny amount (hundreds of millions) compared to notional

amounts involved (tens of billions for the CPI contracts). But in my view the similarities end there.

Even though people like to classify them as such, I never

really considered the CDS investments to be macro bets, just that the bets had

macro consequences. When Fairfax first landed on my radar years ago, I read all of Prem’s

previous letters and I remember being blown away by them. Many of them were real gems

especially regarding the last crisis like these excerpts from as early as the 2003

letter (published in 2004).

“We have been concerned for some time about the risks in asset-backed bonds, particularly bonds that are backed by home equity loans, automobile loans or credit card debt (we own no asset-backed bonds). It seems to us that securitization (or the creation of these asset-backed bonds) eliminates the incentive for the originator of the loan to be credit sensitive. (…)

This is not a small problem. There is $1.0 trillion in asset-backed bonds outstanding as of December 31, 2003 in the U.S. (excluding first mortgage-backed bonds). At the end of 2002, more than 65% of these bonds were rated A or above. In fact, as of December 31, 2002, there were more than 2,500 asset-backed issues rated AAA – significantly more than the 13 U.S. corporate issuers currently rated as AAA. Who is buying these bonds? Insurance companies, money managers and banks – in the main – all reaching for yield given the excellent ratings for these bonds.”

This was, in my opinion, a perfect

case of them identifying problematic securities that were quickly getting out

of hand. And then, eventually, even more mispriced securities, the CDS

contracts, allowed them to take advantage of this situation in a very

concentrated manner by being asked to put up only a few basis points in premium

to cover billions in notional value. And they figured out the companies that

were exposed, all you have to do is look at the entities they bought CDS

insurance against: WAMU, AIG, Fannie, Freddie, Societe Generale, MGIC etc… Stop

me if you’ve heard any of these names before. So yeah, they pretty much nailed

it. But not necessarily macro calls in my opinion.

I’ve also had this argument with different people when it comes to Mike Burry and his bets, he’s said

many times that he spent thousands of hours reading one CDO prospectus after another

and he picked those he was sure contained loans that had been extended

to people who couldn't pay. One of my favorite quote from Burry is when he said

that after everybody gave him a hard time and he dismantled Scion Capital, he

kept one of those CDS contracts simply out of spite just to prove that it would

go to zero and he’d collect the full amount (and it did).

Again, I must

emphasize that despite the macro consequences of these bets, I don’t think they

were macro bets. I think both Burry and Watsa would be lying if they told you

that they had foreseen that some dude in Arizona would stop paying his mortgage

and it would lead to Iceland imploding.

Now for the CPI derivatives, well… Let me just let Prem make the case himself, here are some quotes from his letters explaining their thinking:

“Inflation in the U.S. and Europe, after five years of huge fiscal stimulus, is still in the 1% area – and falling. We remind you that it took five years after the stock market crash in 1990 before Japan saw deflation – and this deflation continued for most of the following 19 years.”

“The U.S. total debt/GDP ratio is at a very high level and significant deleveraging is yet to come.”

“QE1, QE2 and QE3 have helped the financial markets but have not worked in the real economy. What happens when everyone realizes that the Fed and the ECB have no more bullets?!”

“You will remember, we consider the 2008 – 2009 contraction to be a one in 50 or a one in 100 year event – similar to the 1930s in the U.S. and Japan since 1990.”

And sometimes these macro calls are

coupled with subtle attempts at market timing (see below how yet another reminder

about the Japanese deflation comes with a warning that it started 5 years after

the crash. Meaning: it’s been 5 years since 2008-2009 so watch out it’s coming)

2013 Letter:

“As we did last year, we remind you that cumulative deflation in the U.S. in the 1930s and Japan in the ten years ending 2012 was approximately 14%. It is amazing to note that including 2013, Japan has suffered deflation in most of the last 19 years – beginning about five years after the Nikkei index and real estate values peaked.”2012 Letter –

“We did remind you last year but here it is again – cumulative deflation in Japan in the past ten years and in the U.S. in the 1930s was approximately 14%!! It is amazing to note that including 2012, Japan has suffered deflation in 17 of the last 18 years – beginning about 5 years after the Nikkei Index and real estate values peaked.”

I'm sorry but there really is no other way to look at it. These are just macro calls plain and simple and I don’t care who you are or what your track record is, I don’t think anybody can successfully predict macro events consistently. Especially very broad claims like: Remember the Japanese deflation, it’s going to happen to the US! Who the hell knows really, I wouldn't even pay any attention if it was Ben Bernanke saying that we are about to enter years of deflation.

Or the fact that the US has very high debt to GDP – In my humble opinion, people like to fool themselves in thinking that they are being prudent or "contrarian" (a favorite term for value investors) when “analyzing” these macro factors and all they’re doing is pointing out only the facts that corroborate their fears. For instance, how would the folks at Hamblin Watsa explain the graph below if someone was to ask about it?

Or the fact that the US has very high debt to GDP – In my humble opinion, people like to fool themselves in thinking that they are being prudent or "contrarian" (a favorite term for value investors) when “analyzing” these macro factors and all they’re doing is pointing out only the facts that corroborate their fears. For instance, how would the folks at Hamblin Watsa explain the graph below if someone was to ask about it?

The US debt to GDP ratio was higher in the 1940’s and still it was followed by decades of economic expansion, deleveraging, bull markets AND inflation, sometimes very high inflation. My point being that nobody knows really, and I don't see why the Hamblin Watsa team should be able to make these calls other than macro is so tempting sometimes especially when you're off a great success like their 2007-2009 results.

4. Blackberry

No, the issue is bigger and can be found in this blurb from Prem in his latest letter:

“No sooner had the ink dried (almost!) after I wrote to you in last year’s Annual Report about BlackBerry, than BlackBerry became a daily headline. The Board of Directors of BlackBerry decided to form a Special Committee to look at all options for the company. As we were the biggest shareholder in the company (almost 10%) and were potentially conflicted by my being on the Board, I decided to resign as a director so we could review all our options.

On September 23, 2013, Fairfax made an offer to take BlackBerry private at $9 per share, subject to a six-week due diligence period. To do our due diligence, we hired a very experienced team led by Sanjay Jha, who ran Motorola, Sandeep Chennakeshu, who was President of Ericsson Mobile Platforms, and John Bucher, who was Chief Strategy Officer at Motorola Mobility. Briefly stated, their conclusions were simply:

1) the company had excellent assets,

2) the management teams had made many mistakes along the way, and

3) the company could not afford high cost LBO debt. For the first time in our history, our due diligence resulted in our not being able to complete an announced deal.”For the life of me I cannot understand why this has just flown under the radar without many people challenging it.

So we are supposed to believe that the Hamblin Watsa team, with Prem being the dominant director on the board and Fairfax being the biggest shareholder, somehow waited for some consultants to come and school them on the value of Blackberry and what was feasible AFTER they had introduced a cash offer to take the company private with all the financing already lined up according to Prem himself. And that would be why the offer was pulled? Plus all this was done with Fairfax’ reputation on the line!

In short, I don’t buy one word of it, I believe the Hamblin Watsa team is more than capable of doing their own analysis. Unfortunately the logical corollary to this statement is really bad, because that would mean that Prem is being disingenuous.

What happened, again in my humble opinion, is pretty clear, Fairfax introduced their offer, then gave a couple of months to the Blackberry BOD to shop the company around and see if they could fetch a bigger deal. But there was no taker and when it was time to pay, well, the financing was probably just not there. Also, the subsequent convertible debt financing that Fairfax raised for BBRY (in which Fairfax invested hundreds of millions itself) was done around the same time Fairfax was issuing 1 million shares to raise cash as well as selling some of their equity holdings, some of it probably went to the BBRY deal, and lest we forget the market was also advancing mightily causing them to have to commit more cash when their swaps reset. So I just don't think they had the means to carry through with it without other financial backers. And on top of that a quick internet search will show you articles like these "Fairfax said short of blackberry bid financing" were coming out at the time.

What happened, again in my humble opinion, is pretty clear, Fairfax introduced their offer, then gave a couple of months to the Blackberry BOD to shop the company around and see if they could fetch a bigger deal. But there was no taker and when it was time to pay, well, the financing was probably just not there. Also, the subsequent convertible debt financing that Fairfax raised for BBRY (in which Fairfax invested hundreds of millions itself) was done around the same time Fairfax was issuing 1 million shares to raise cash as well as selling some of their equity holdings, some of it probably went to the BBRY deal, and lest we forget the market was also advancing mightily causing them to have to commit more cash when their swaps reset. So I just don't think they had the means to carry through with it without other financial backers. And on top of that a quick internet search will show you articles like these "Fairfax said short of blackberry bid financing" were coming out at the time.

So, again, if the money wasn't there, why not say the money wasn't there and not talk about some consultants coming in and making the decision for them?

The reason all of this is a big issue for me is because as Prem puts it himself “Our reputation is now our biggest strength – and one we guard fiercely.” Unfortunately events like these have been chipping away at that reputation in recent years. I remember attending the shareholder meeting a couple of years ago and it was smack in the middle of the Resolute – Fibrek saga, and at one point one elderly lady grabbed the mic to ask Prem how he can be part of such a deal that is pretty much screwing small Fibrek investors and still claim to be "fair and friendly" (paraphrasing from memory here but others can confirm). It seems like controversy is beginning to be part of the Fairfax brand.

The reason all of this is a big issue for me is because as Prem puts it himself “Our reputation is now our biggest strength – and one we guard fiercely.” Unfortunately events like these have been chipping away at that reputation in recent years. I remember attending the shareholder meeting a couple of years ago and it was smack in the middle of the Resolute – Fibrek saga, and at one point one elderly lady grabbed the mic to ask Prem how he can be part of such a deal that is pretty much screwing small Fibrek investors and still claim to be "fair and friendly" (paraphrasing from memory here but others can confirm). It seems like controversy is beginning to be part of the Fairfax brand.

I really regret that I didn't get back in time to attend the meeting this year but I would have loved to get to ask some of these questions to someone in the Fairfax team. Hopefully someone out there was able to ask questions like: Are reports by outside consultants really why the Blackberry deal didn’t go through? Or do the cash requirements attached to the derivatives have anything to do with Fairfax selling stocks like WFC (as opposed to them being high/overvalued)? Etc.

5. The Letter - General Thoughts

One little incidental/anecdotal point that I’d like to raise because I saw it raised on the CoBF board a few times is the long term track record of Fairfax.

For those of us who have read all of Prem’s letters we know that “Long Term” is his favorite term to use. Here’s some useless data for those of you with time to waste: I just ran a quick search through his last 5 letters and the results are in, long term is mentioned: 29 times in 2014, 26 times in 2013, 23 times in 2012, 22 times in 2011 and 25 times in 2010.

I know all this is just anecdotal and it’s just tongue in cheek but I think it has its importance. I wonder if one day we'll get to ask Prem for a number for what he means by long term?

Usually it goes a little something like this:

- Don’t look at our mark to market losses, they’re just fluctuations – worry about the long term.

- Don’t look at our book value increase (or decrease) over the last x number of years, look at the long term and our long term goal is to compound BV at 15% and we’ve done 20%+ in our history”

I saw a few people mentioning that if you look at it closely their BV compounding drops significantly if you take out the first few years when Fairfax was very small.

Here’s the thing about that: First, they're right, and second I’ve grown to learn that a lot of people don’t want to do the math themselves and prefer to just repeat what management tells them and call it analysis, luckily for them, I've done the math and here’s what Fairfax BV CAGR looks like over the last 5 – 10 -15 – 20 and 25 years.

Now, let me first say this as I know many people will bring up this point (and by the same token miss my point). In no way am I making any absolute judgment on whether or not these are good or acceptable returns (I think they are). All I’m trying to point out is that over the past 20 years Fairfax has fallen short of their own goal of growing at 15% (so I guess 20 years is not long term), you need to go back 25 years in order to get to the 15% benchmark and all the way back to the beginning of the company 28 years ago to see the 20% number everybody talks about. Again remember that I’m only pointing out their own yardstick, not mine, personally I think these are great returns.

Let me put it this way, if a manager came to you and asked you to manage your money and told you that his goal was to compound it at 15% “over the long term” and you should judge him by that and remunerate him also based on that. How would you go about evaluating his performance if 5, 10, 15, 20 years later he was still below that benchmark?

As a comparison here’s how Berkshire has fared over the same 25 years period. And you’ll be surprised to see (maybe you won’t) that BRK beats Fairfax in BV compounding even though BRK in 1988 was more than 400 times bigger than Fairfax with a BV of $3.4B vs $8M.

As a comparison here’s how Berkshire has fared over the same 25 years period. And you’ll be surprised to see (maybe you won’t) that BRK beats Fairfax in BV compounding even though BRK in 1988 was more than 400 times bigger than Fairfax with a BV of $3.4B vs $8M.

I'm not going to pretend to be an expert at this value investing thing and that I’ve been at it for decades, nope, but I like to think of myself as a fast learner; and one thing that I learned very fast when I got immersed in the value investing World is how Buffett is different from the hundreds if not thousands of people out there who make it a point to quote him every other sentence.

He just cares about businesses that’s all, simple as that, while others use his quotes like “be fearful when others bla bla bla (you’ve all heard it)” to talk themselves into investments like a “contrarian” bet on Japanese style deflation.

And what does Buffett do in the meantime? Well, he buys one of the biggest and best run railroad, when a Lubrizol comes up and he likes it? He snatches it up. Same with Heinz, who knows what inflation or deflation numbers will be like? Just like many of us, he probably can’t remember the last time his fridge didn’t have at least one bottle of ketchup in it. And while Fairfax is selling WFC and US Bancorp, Buffett has used the post 2008 crisis era to build a humongous stake in the financial industry… Oh the banks… Here's a little additional side note (since this post is not long enough), a few years ago when I was studying the banks really hard to get comfortable with them and eventually invest a lot of my money in them, I built this table just because I was wondering what % of the total US banking industry BRK represented since it looked like Buffett was putting a lot of money into the banks. Here it is updated for 2013 for total deposits and assets:

What this table shows is that on a look through basis Buffett has built BRK to own 2% of the entire US banking deposit base (same for total assets). If anyone is wondering, based on these numbers, if BRK was a stand alone bank, they would be around the 8th position in size after PNC and ahead of Capital One. And he gets to build BRK's banking presence by picking the specific franchises he likes best. Also, unlike others, you can believe him when he says that he won’t sell his Wells Fargo shares and all these positions will go on increasing in value and importance as banks grow and buyback shares etc.

Anyways, this is just a big parenthesis to show what Buffett is busy doing while so many value managers spend their time talking/complaining about the macro picture, this includes some of the most respected managers.

Let me finish this long winded rant on a slightly harsher note (if that’s possible) by saying that I do not care one iota whether Fairfax ends up being right on any of the things discussed above (Blackberry, Deflation, Hedges etc.) It matters nada, zero, zilch to me!! Because I don’t care what your track record says, I just don’t like your odds in the long term if you suddenly get in the business of being a prophet predicting the second coming of the great Japanese deflation or start betting on struggling tech companies that are losing market share and burning cash.

At the end of the day Prem and the Hamblin Watsa team are very successful (and very rich already) and my job is to worry about my own and my family’s capital and I don’t think that the current Fairfax route is the way to go if I want to both sleep well at night and compound my money for the future. But who knows they might change course and I might change my mind as well.